Payroll deductions online calculator 2023

For annual Australian taxable wages over the 13 million threshold the deduction will change to 1 for every 7 of taxable wages over this amount. Product Services.

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator

I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay.

. Analytics for employers and payroll professionals. Married Filing Separately - You are married and your spouse files. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

The salary calculator for income tax deductions based on the latest Australian tax rates for 20222023. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year. Submit payroll information online.

This calculator uses the redesigned W-4 created to comply with the elimination of exemptions in the Tax Cuts and Jobs Act TCJA. The guidance has been updated to reflect off-payroll working changes that came into effect on 6 April 2021. Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no dependents no itemized deductions and certain types of income including wages salaries tips taxable scholarships or fellowship grants and unemployment compensation.

Assessment year 2023 just do the same as previous step with your. Married Filing Jointly - If you are married and are filing one joint return for both you and your spouse. That said dont think its OK to be creative with tax deductions because the ATO will analyse every expense you claim.

Online competitor data is extrapolated from press releases and SEC filings. The new myePayWindow is available at no extra cost to existing OpenPayslipsOpenEnrol users and will replace the current functionality in your payroll software for publishing documents. Deductions are something only you can keep track of.

We also offer a 2020 version. To a maximum of 5000 business kilometres per car Deductions are only applicable to cars. Mileage calculation provided by the Australia Taxation Office - 78 cents per kilometre from 1 July 2022 for the 2022-2023 income year.

To a maximum of 5000 business kilometres per car Deductions are only applicable to cars. Self-Employed defined as a return with a Schedule CC-EZ tax form. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

1 online tax filing solution for self-employed. For more information see WA Department of Finance. Changes from January 2023.

Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS. As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023.

In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. If you specify you are earning 2000 per mth the calculator will provide a breakdown of earnings based on a full years salary of 24000 or 2000 x 12. Your filing status determines which set of tax brackets are used to determine your income tax as well as your eligibility for a variety of tax deductions and credits.

Pay dates are the last work day on or before the. They compare your deductions against other people in your line of work your location your industry your age group and their own benchmarks. But instead of integrating that into a general.

How to calculate income tax in Australia in 2022. 1 online tax filing solution for self-employed. The Payroll Office is responsible for the final payroll process that issues payment advices via direct deposit and payroll checks if applicable to all regular full-time part-time and temporary employees of the Prince William County School Board.

The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more. Please note this calculator is. When it is time to switch we will support you your employees and clients if applicable with the migration.

WA State Budget 2022-23 12 May 2022 Payroll tax measures announced in the 2022 WA State Budget include. Select the columns you would like to display on the wage summary table. PCB Calculator Payroll EPF SOCSO EIS and Tax Calculator.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Enter your filing status income deductions and credits and we will estimate your total taxes. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Remotely submit payroll information to a payroll processor multi-location facility or mobile. The calculator is updated for the UK 2022 tax year which covers the 1 st April 2022 to the 31 st March 2023. And enter whatever allowable deductions for 2021 to calculate the total amount of tax for 2021.

Single - You are unmarried and have no dependants. Calculating income tax in Australia is easy with the. The Australian Salary Calculator includes income tax deductions Medicare Deductions HEPS HELP calculations and age related tax allowances.

Tax deductions not guaranteed due to being subject to user data entry errors. All payroll is processed and paid on a semi-monthly pay period schedule. Tax deductions not guaranteed due to being subject to user data entry errors.

Likewise if you need to estimate your yearly income tax for 2022 ie. If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. From 1 January 2023 the deduction range will increase which means a reduction in payroll tax for small and medium businesses.

Payroll Tax Western Australia This is general information and not advice. Online competitor data is extrapolated from press releases and SEC filings. Deductions taxes benefits and vacation as well as hundreds of reports including many user defined reports.

Dont forget to change PCB year to 2021. The annual payroll tax liability threshold enabling quarterly payments instead of standard monthly increased. Self-Employed defined as a return with a Schedule CC-EZ tax form.

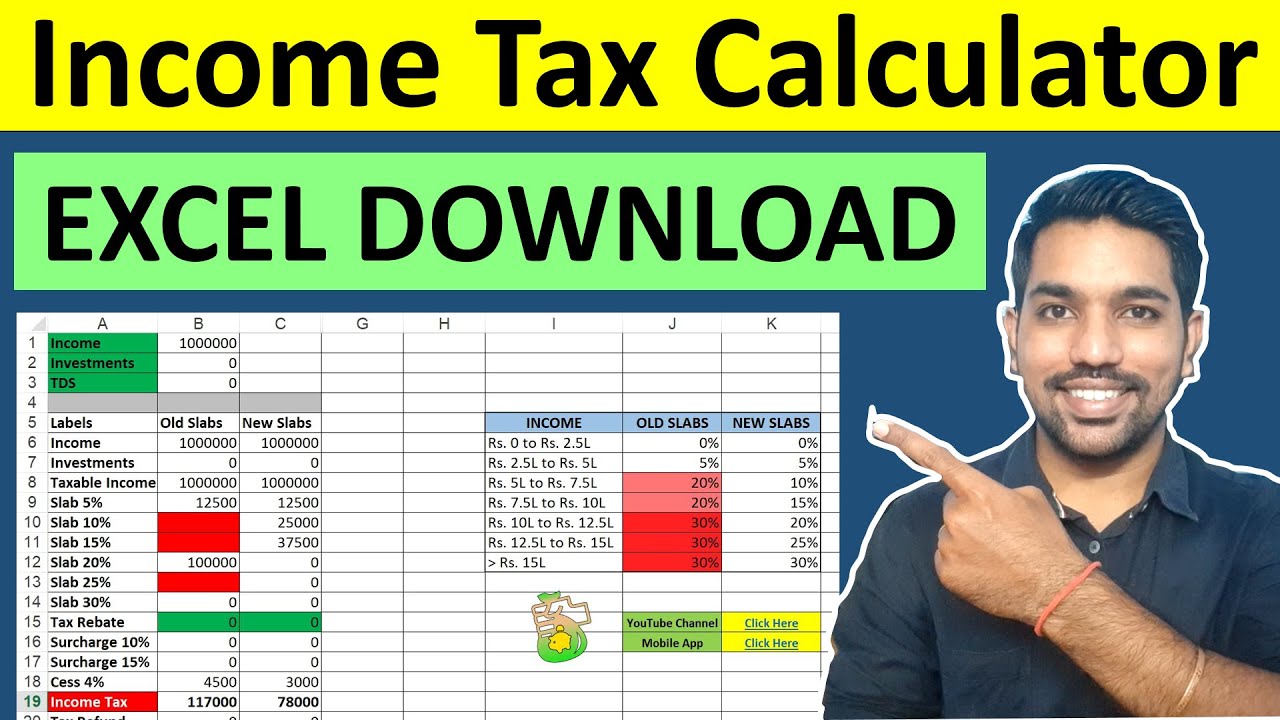

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

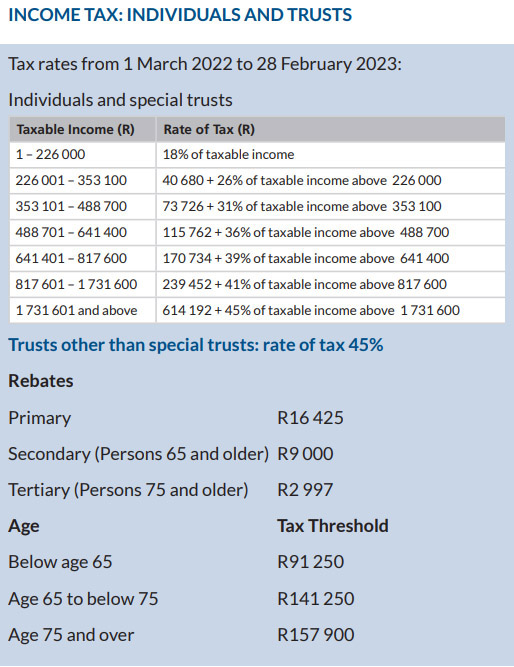

Budget 2022 Your Tax Tables And Tax Calculator Bvsa Ltd More Than Just Numbers

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Cost And Deductions Paid Family Leave

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

South Africa Tax Calculator 2022 2023 Calculate Your Tax For Free Youtube

Estimated Income Tax Payments For 2022 And 2023 Pay Online

South African Tax Spreadsheet Calculator 2022 2023 Auditexcel Co Za

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

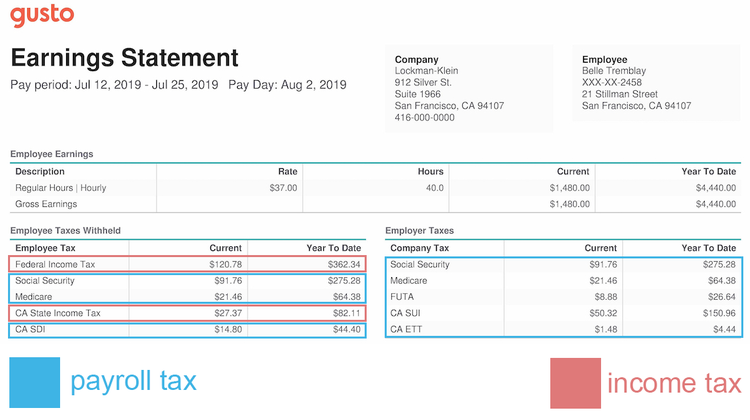

Payroll Tax Deductions Business Queensland

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Payroll Tax Vs Income Tax What S The Difference

Income Tax Calculator Apps On Google Play